SCROLL

DOWN

San Francisco-based Roofr, a tech firm start-up, raised $23.5 million in a Series A+ funding round led by Vertical Venture Partners, welcoming participation from ABC Supply Co. and several new and existing investors, including Bullpen Capital, Interplay Ventures, i2BF, SVB, Ace & Company, MGFO and Podemsky Ventures.

The company highlighted ABC Supply's investment, saying in a news release that the distributor’s inclusion underscores the “promising future” of Roofr's platform “that will ultimately make [end-users’] business faster, stronger, and more streamlined.”

Roofr has made a name for itself and its software through its $10 measurement reports, estimates and proposals software, and user-friendly platform.

ABC Supply's director of Business Platform and Customer Enablement, Kris Kieffer, said: "We believe Roofrs' potential to streamline operations and drive growth will have a significant impact on the lives of roofers."

Roofr said it plans to focus on improving its popular utilities like Roofr Measurement Reports, Proposals, and Instant Estimator; it also anticipates creating new features based on roofers' feedback and their pain points.

The company also plans to expand teams, including engineering, research, product development, sales, and marketing [to] meet the evolving needs of its growing customer base as it plans to release features including “Payments, Material Purchasing, and Customer Communication.”

Brad Corona, managing director at VVP, said his firm was “thrilled” to lead Roofr’s funding round, adding, “[s]ince our original investment last year, our belief in Roofr's potential to disrupt the market, enhance efficiency, and drive sustainability has deepened significantly.”

Roofr Raises $23.5M in Series A+ Funding Round

Photo courtesy of the Iowa Economic Development Corporation

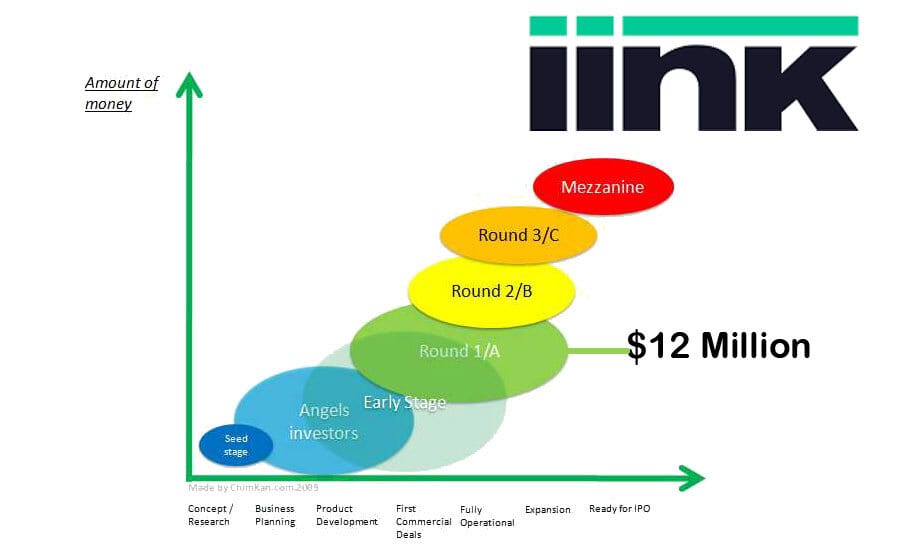

Tampa, Fla.-based digital payments network iink announced it raised $12 million in a Series A financing round led by the global venture capital firm Headline, which included participation from Motley Fool Ventures, Chartline Capital Partners, Silver Circle Ventures and existing investors.

The company, which expedites the disbursement of funds associated with multi-party property insurance claims, said the financing would allow it to invest in strategic integrations with mortgage servicing banks and insurance carriers to create an entirely digital and automated workflow.

iink said it is well positioned to act as a conduit for carriers, banks, contractors, and property owners to communicate and keep the restoration process moving.

“iink has seen great success to date tripling in size since our last round by innovating in an industry that has historically been underserved when it comes to technology,” said Tom McGrath, iink CEO/co-founder. “Our vision is not only to expedite payments but to also position ourselves as a fintech company that provides specialized financial capabilities to our customers by partnering with outside banks — a platform for property restoration professionals to operate and grow their business in a way that has never been supported before.”

King Goh, partner at Headline, the VC leading the round, said: “We believe that their growth trajectory points to a future … facilitated through digital innovation [and] iink stands as a beacon of innovation in an industry ripe for transformation, bringing efficiency to a traditionally fragmented process for all stakeholders involved in property insurance claims.”

iink Raises $12 Millon in Series A Financing Round

Roofing Contractor magazine, North America’s premier publication covering the commercial and residential roofing industry, announced a new collaboration with the advocacy group Latinos en Roofing, highlighting the importance of Latino contractors and workers.

For more than 40 years, RC has been the preeminent source of information for roofing contractors, suppliers, and distributors on new products, best practices, innovation, and business news involving the building envelope’s "peak" element.

With insight from the industry’s foremost thought leaders, RC examines every facet of the roof system, including design, materials, innovation, legal and regulatory updates, company and personal profiles, news, advice, and more, and it’s time to expand our mission further.

“We are so excited about this new endeavor and our partnership with Latinos en Roofing,” Jill Bloom, group publisher at BNP Media, said, whose portfolio includes RC and Best of Success, among others.

“There are so many members in the roofing industry who are really thirsty for the knowledge that groups like Latinos en Roofing provide,” Bloom added. “Our job, passion and mission at Roofing Contractor is to educate our audience, including our Latino readership.”

According to the U.S. Bureau of Labor Statistics, Latino contractors now account for 30% of all roofing professionals, a 40% increase from 2010, when the figure stood at just 11%. However, nearly 60% of the industry’s overall labor force is estimated to be Latino, and Bloom said a lack of parity requires tailored outreach efforts.

Bloom stressed that RC cannot fulfill its mandate if a significant percentage of its readership is neither recognized nor served, which is why she believes including Latino-centric content is a concept long overdue.

“The goal of Roofing Contractor is to connect this amazing family of roofing professionals further, and we want to emphasize how important Latinos are to the roofing community,” Bloom said. “If we aren’t speaking to every part of our family, we are falling short, and that is something we refuse to accept.”

Roofing Contractor Magazine Partners with Advocacy Group ‘Latinos en Roofing’

Six Pillars Partners, a Texas-based private equity firm focused on the lower middle market, led the recapitalization of Royalty Roofing and its sister company, Majestic Facility Experts, to support its nationwide plans for expansion.

Headquartered in Seymour, Ind., with satellite locations in Warsaw, Ind., Fort Myers, Fla., and Orlando, Fla., Royalty provides national reroofing, maintenance, inspection and repair services predominantly to commercial customers.

Based in South Bend, Ind., Majestic manages a network of technicians and trade experts throughout the U.S. to fulfill the repair and facility maintenance needs of its national, regional, and local commercial clients. Royal Roofing, a 2021 Top 100 roofing contractor, will remain under the helm of Founder and President Andy Royalty.

"Our entire management team is excited about the enhanced growth opportunities this new partnership will bring. Six Pillars is a great fit not only for the strategic expertise they bring to the table, but more importantly, for the value they place on caring for our people," Royalty said in a news release.

Centerfield Capital Partners, Petra Capital Partners, Concentric Investment Partners, and UMB Capital Corporation provided capital to support the transaction. The company also engaged Tyler Rudman to join its Board of Directors and help guide inorganic growth efforts.

"We're thankful to be able to partner with successful entrepreneurs, founders and operators … who have built businesses on the foundation of passionately serving their employees, customers, and community," said Teddy Saltzstein, Partner at Six Pillars Partners.

Royalty Roofing, Majestic Facility Experts Recapitalized Through PE Firm Six Pillars Partners

The third quarter of 2023 marked a continued decline in the shipment of asphalt roofing products in the United States and Canada, according to the Asphalt Roofing Manufacturers Association's 2023 Quarterly Product Shipment Report.

The report showed a significant drop in the shipment of shingles, built-up roofing, and modified bitumen compared to the previous quarter, following a trend seen in the past two years. The decrease was seen in the following areas:

- U.S. Shingles: 46 million, down 11.6%

- BUR Base, Ply, and Mineral Sheet Caps: 1.5 million, down 17.5%

- Modified Bitumen: 11 million, down 5.6%

- Canada Shingles: 1.9 million, down 20.8%

The shipment decline is attributable to ongoing supply chain challenges influenced by factors including material price increases, inflation, labor shortages, and global conflicts. However, despite recession fears, the construction industry continues to show resilience outside labor shortage-related issues.

Notably, Q3 2023 saw a record number of modified bitumen shipments compared to previous third quarters, with 11 million reported. In contrast, Canadian shingles experienced its worst third quarter in ARMA's history.

When comparing year-to-year shipments, ARMA observed some variations: U.S. shingle shipments increased by 15.9%, while BUR base, ply, and mineral sheet caps decreased by 18.1%, and modified bitumen increased by 18.2%. Canada shingle shipments were down by 38.3%.

Overall, the year-to-date shipment totals for 2023 showed a mixed picture, with some products reaching record lows in Q3 history. BUR and Canadian shingles hit their lowest year-to-date Q3 totals, while modified bitumen reached its highest.

ARMA Q3 2023 Report: Asphalt Product Shipments Drop in Third Quarter