HOLCIM

DURO-LAST

ACQUIRING

The Swiss Company’s $1.29 Billion Acquisition Solidifies its Place in North America’s Roofing Market with PVC Presence

By Art Aisner and Chris Gray

Holcim’s footprint in roofing just got larger.

The multi-national conglomerate announced in February the acquisition of roofing systems manufacturer Duro-Last for $1.29 billion.

Michigan-based Duro-Last launched more than 40 years ago, currently employs around 840 workers and reports annual sales of roughly $540 million. Holcim says the deal will complement its integrated roofing offerings, increasing that division’s revenues by $60 million annually.

“I’m excited to welcome Duro-Last into Holcim’s broad range of innovative and sustainable building solutions,” Holcim CEO Jan Jenisch said in a release. “Duro-Last is a perfect strategic fit for our roofing business. Its proprietary technologies and leading brands complement our offering in the fast-growing North American market. Its energy-efficient systems and excellence in recycling will further advance our leadership in sustainability.”

Swiss-based Holcim operates building materials companies in roughly 70 countries with more than 71,000 employees. It is the largest cement producer in multiple markets, including Australia, India and throughout Latin America. Since its acquisition of competitor Lafarge in 2014, the company has aggressively expanded in multiple continents.

The Duro-Last acquisition makes this one of the largest deals Holcim has executed in North America, but it is hardly the first. In early 2022, it acquired Malarkey Roofing Products for $1.35 billion in a move that demonstrated plans to further its reach in the residential roofing market. Last fall, Holcim picked up the Polymers Sealants North America (PSNA) division of Illinois Tool Works — a leader in coating, adhesive and sealant solutions with net sales of $100 million in 2022.

Holcim also acquired Firestone in April 2021, and rebranded to Elevate. The move signified the company’s strength in the commercial roofing space across multiple product categories. Firestone previously acquired Gaco Western, a leader in innovative silicone roofing systems and provider of top-tier waterproofing and spray foam insulation. Also in the fold is GenFlex Roofing Systems, a leader in polyiso insulation.

In an exclusive video chat with RC shortly after Holcim’s Firestone acquisition and purchase of SES Foam in Houston, Jamie Gentoso, global head of Holcim’s Solutions and Products Business unit, said the company tripled its ability to serve the spray foam market. She also hinted that they weren’t done with acquisitions.

“We’re going to continue to invest in key areas like coatings and from a product innovation perspective, we’re going to continue looking at other companies that can bring products to us,” she said.

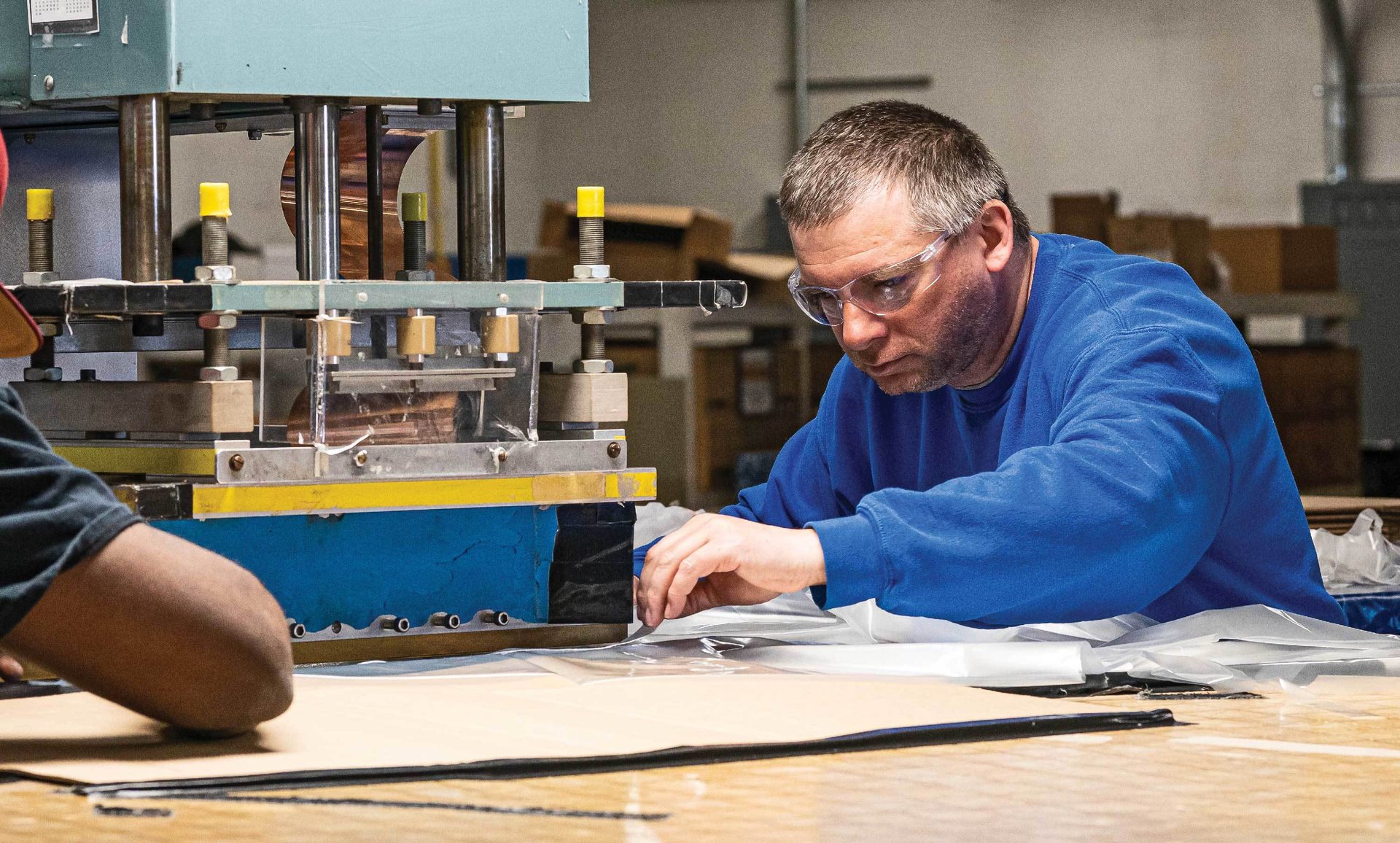

Michigan-based Duro-Last employs roughly 840 workers that produce a variety of roofing and building envelope solutions, including cool roofs that enhance energy efficiency.

Reactions from roofing professionals on social media were mostly positive, though some expressed their desire for the company to remain “as-is.”

“It’s exciting to see Holcim investing in this amazing brand and product. We know this transition will be seamless for all team members, contractors, and suppliers, and we can’t wait to see where it takes us! #BuckleUp,” wrote Coryell Roofing and Construction in a LinkedIn post.

“Duro-Last is making moves. Don’t change your company culture!” said Zack Taylor of Woodall Companies on RC’s LinkedIn page.

In response to concerns about the company and its operations following the acquisition, Duro-Last took to LinkedIn assuring customers they can expect the same service.

“Yes, Holcim recently purchased Firestone Building Products and rebranded them under a new name (Elevate). While we will share a parent company, Duro-Last and Elevate will remain independently operated. And the Duro-Last brand is so strong, we will retain our name sake. Duro-Last. Same people. Same great product. New owners,” the company stated.

Duro-Last’s systems include cool roofs, enhancing buildings’ energy efficiency and its award-winning “Recycle Your Roof” program, which drives circularity in roofing. Duro-Last is the first company in the U.S. to offer third-party verified environmental product declarations for its thermoplastic roofing solutions.

“Over the past 45 years, our family business has continually reinvested in Duro-Last to create the solid, financially strong and well-recognized company we are today,” said Tom Saeli, CEO of Duro-Last, in a release. “We are delighted to be joining the Holcim family, which shares our core values, and we look to the future to accelerate our success. Holcim recognizes the opportunities at Duro-Last and we are confident it will support us in our future growth plans.”

The Duro-Last acquisition advances Holcim’s “Strategy 2025 – Accelerating Green Growth,” seeking to expand its Solutions & Products business to 30% of group net sales by 2025. The company expects the Duro-Last acquisition to close by the second quarter this year and projects its roofing systems to exceed $4 billion in net sales.

Art Aisner is editor-in-chief of Roofing Contractor. Reach him at 248-244-6497 or aisnera@bnpmedia.com. Chris Gray is editor of Roofing Contractor. Reach him at 248-244-6498 or grayc@bnpmedia.com.