2023 State of the Industry: Who Took This Year’s Survey?

By Chris Gray

To check the pulse of the roofing industry, RC and Clear Seas Research reached out to roofing professionals from around the nation and asked their thoughts on the state of roofing. Through their answers, we can better understand the trends and challenges facing contractors in the coming year.

This year’s survey was sponsored by Adams and Reese. The online survey went out to subscribers of RC, with each respondent receiving a $15 gift card for their participation. Here’s a look at this year’s respondents.

Residential vs. Commercial

Like previous surveys, this year’s respondents hail from both the residential and commercial sides of the industry and are involved with at least one of the leading roofing product categories. This year, 58% identified as mostly residential, 32% as mostly commercial and 10% as mixed.

Gender and Ethnicity

Respondents in this year’s survey were primarily male (79%), though the number of women participating has grown from last year (21% from 17%). The majority of participants identified as white or Caucasian (93%), followed by Hispanic or Latino.

Age

The mean age of respondents was 49 years old. The largest age group was 40 to 49 years old (33%) while the next largest groups were 50 to 59 years (28%) and 30 to 39 years (19%). Last year, the largest was ages 50 to 59 (31%).

These findings hint at an aging workforce, but could also be signs of the next generation making their presence known in the roofing industry.

Role and Performance

In terms of their role at their company, the largest group comprised of corporate or executive management (45%), followed by general management (24%) and installers and technicians (21%).

Regarding company performance, 16% of companies grossed an annual revenue of $2 million to $4.9 million, while 14% of companies reported annual revenues between $5 million to $9.9 million.

The median of company sizes was 10 to 25 employees, with 29% of respondents working at companies with fewer than 10 employees. A quarter of respondents have 10 to 25 employees.

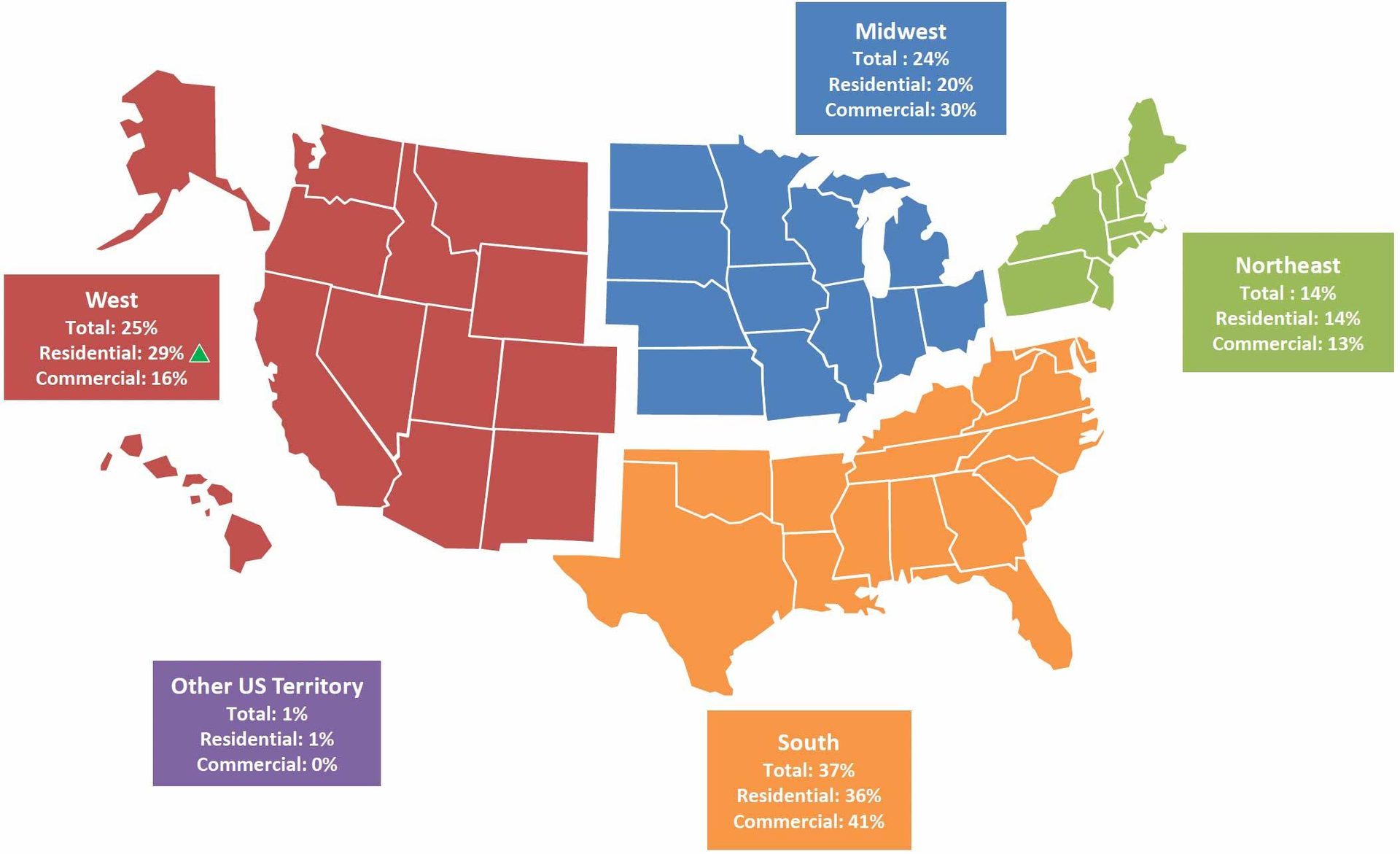

Region

Participants hailed mostly from the South (37%), followed by the West (25%), Midwest (24%), Northeast (14%) and other U.S. territories (1%).

The majority of contractors identifying as primarily residential hailed from the South (36%), followed by the West (29%). Compared to last year, the Midwest had the second-highest representation.

Commercial contractors taking the survey mainly hailed from the South (41%), while the Midwest was the next largest region represented (30%). This is consistent with last year’s survey.

Chris gray is editor of Roofing Contractor. Reach him at 248-244-6498 or grayc@bnpmedia.com.