Who Took RC’s 2022 Annual State of the Industry Survey?

Data provided by Clear Seas Research

For the 14th consecutive year, Roofing Contractor and Clear Seas Research reached out to roofing professionals across the country to collect their thoughts on the residential and commercial markets in 2021, and to gauge perspectives about the year ahead. Here’s a closer look at who responded to the annual RC State of the Industry survey, sponsored by Cotney Attorneys & Consultants.

The target audience for this year’s survey included roofing contractors in the United States that are involved with at least one of the leading roofing product categories. The online survey circulated last fall to subscribers of RC’s eMagazine, digital newsletters and eBlasts.

The results from this year’s survey show about 64% of respondents identified themselves as residential roofing contractors – by generating more than half of their business revenue in that sector. Of those, most said at least 30% of their revenue generated from steep-slope asphalt shingles; 18% said metal; and 14% said single-ply.

About 28% of contractors identified as commercial roofers. Among those, the majority indicated 38% of revenue came from single-ply roofing; 14% said metal; and 10% each responded with coatings and low-slope asphalt. Eight percent of survey respondents identified mixed revenue from commercial and residential markets.

Gender

- The overwhelming majority of survey respondents (83%) were men.

- The number of this year’s female respondents (17%) is slightly higher than last year, and remains relatively consistent in each of the last three State of the Industry surveys commissioned by RC.

Age

- The mean age of the survey respondent was 49 among both residential and commercial roofing contractors.

- The largest age group represented among roofing contractor respondents (31%) were those between ages 50-59. That’s back after dipping below the age 50 barrier for the first time in six years in 2020.

- The next largest segment among the contractor respondents (25%) was between ages 40-49, while 16% were between ages 60-69.

- Twenty percent of respondents said they were between ages 30-39; and just 3% said they were under age 29.

- Five percent of all survey respondents were 70 years old or older.

Rank and Performance

- Forty-three percent of survey respondents were in corporate or executive management positions.

- Roughly 24% were in general management in both the residential and commercial sectors.

- About 21% identified themselves only as roof installers and technicians.

- Nearly 36% said their companies had less than 10 employees; and the majority of those (46%) were from the residential sector.

- About 26% of commercial roofing companies said they had between 10-25 workers.

- Roughly 16% of respondents identified themselves as being with companies that grossed between $2 million to $5 million; 14% said they were with companies grossing between $5 million and $10 million in revenue.

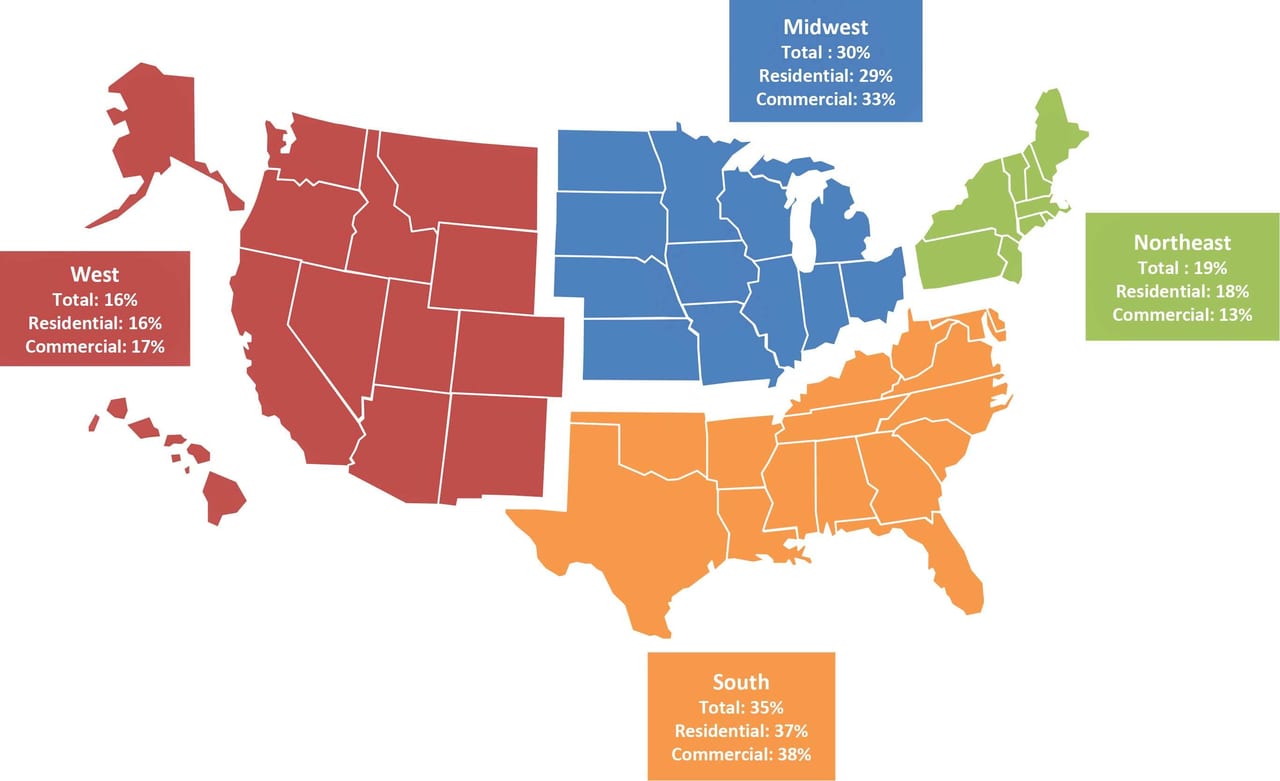

By Region

- The majority of respondents identifying themselves as residential contractors were from the South (37%), followed by the Midwest (29%).

- The majority of respondents identifying themselves as commercial contractors were also from the South (38%), and the Midwest (33%).

- Thirty-five percent of survey respondents were from the South.

- Roughly 30% of the contractors that responded were from the Midwest.

- About 19% of survey respondents were from the Northeast.

- Sixteen percent of respondents said they hailed from the West.