EXIT

PLANNING

Would You Prefer Paying 15% or 57% in Exit Taxes?

Same Company, but Millions Added to the Bottom Line

The challenging COVID pandemic, material shortages, manpower and inflation are a wakeup call for businesses and roofing contractors. These challenges compound the baby boomer goals of exiting, succession, and retirement.

Your company sale outcome will probably depend more on managing your taxes than your value or multiple.

During the challenging exit process, you do not want to be that owner who fumbles the ball in the red zone of their career only to leave a mess for their spouses, family, company, and community.

You may ask, what is the main cause of failure? The U.S. Small Business Administration (SBA) found most companies haven’t planned properly for ownership changes.

“At any given time, 40% of U.S. businesses are facing the transfer of ownership issue,” the SBA states on its website. “The primary cause for failure … is the lack of planning.”

This short article will focus on the three business statistics you need to memorize to understand your risk if you ever intend to cash out.

Kevin

KENNEDY

Photo credit: SrdjanPav/E+ via Getty Images

SCROLL

DOWN

Statistic #1: 70%

Seventy percent of your wealth is trapped inside your illiquid business. Because this number is so large, how do you intend to beat these odds and reduce your tax burden? How will you cash out, retire and not run out of money or alter your post-exit lifestyle?

Statistic #2: 30%

Fewer than 30% of businesses ever sell or transfer. According to the Family Firm Institute, an international association for professionals servicing family-owned enterprises:

• Seventy percent fail to transfer to the second generation

• Ninety percent fail to transfer to the third generation

These are onerous statistics that you can’t afford to ignore for your legacy with your family, management, and employees.

“If you are one of the lucky ones to cash out, then you have the welcoming hands of Uncle Sam waiting for his 'fair share' of your harvest. This can range from zero to over 60%. You need an experienced exit tax adviser that can reduce or eliminate the tax erosion during the exit.”

Statistic #3: Taxes of 60% Plus

If you are one of the lucky ones to cash out, then you have the welcoming hands of Uncle Sam waiting for his “fair share” of your harvest. This can range from zero to over 60%.

You need an experienced exit tax adviser that can reduce or eliminate the tax erosion during the exit.

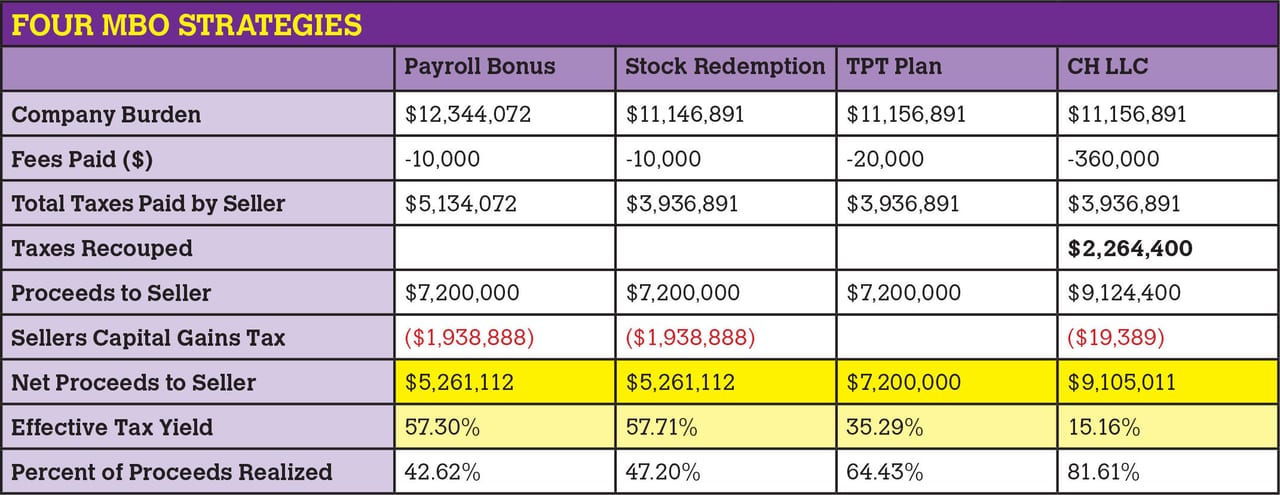

We delivered a plan to an owner whose goal was to sell to his management. This is called a management buyout, or MBO. We illustrated four strategies where taxes on the proceeds ranged from 15.16% to 57.30%

The table below shows the same company valuation of $7.2 million with four different tax strategies and four bottom line outcomes.

Note that the last strategy (CH LLC) will eliminate up to 85% of the capital gain tax and can be applied to real estate investments, privately held business, external company sale, professional practices, fractional interest in LLC, 1031 Exchange or other capital assets.

Taxes are just one aspect of the complicated exit plan, but a critical bottom-line component.

There is around a $4 million difference between the high and low net proceeds to the seller that will have a large impact on the owner’s retirement and lifestyle. Your business exit will probably be the largest financial event of your life and will have a large impact on your retirement and legacy.

And remember, it is not how much you get, but how much you keep.

Kevin Kennedy is the founder and CEO of Beacon Exit Planning. He is a former roofing contractor, construction industry voice and thought leader for exit planning and succession. Kevin is also a co-author of the Amazon #1 Best Seller “The Contractor’s 60 Minute Exit Plan.” Reach him at KJKennedy@BeaconExitPlanning.com.

Tax laws are complex and subject to change. Contact your professionals for tax or legal advice. IRS Circular 230 Disclaimer: To ensure compliance with IRS Circular 230, any U.S. federal tax advice provided in this communication is not intended or written to be used, and it cannot be used by the recipient or any other taxpayer (i) for the purpose of avoiding tax penalties that may be imposed on the recipient or any other taxpayer, or (ii) in promoting, marketing or recommending to another party a partnership or other entity, investment plan, arrangement or other transaction addressed herein